It explains how the plan would help those who cannot afford health insurance now.

It explains how the plan would help those who cannot afford health insurance now.

This page lists resources on health care insurance reform, with special emphasis on the competing plans in the election. It will be updated throughout the term. Those who are especially interested in health care might also want to look at the syllabus for my other course.

The New York Times has a series of articles that explore “medical treatments used despite scant proof they work” and examine “steps toward medicine based on evidence.” Worthy! (Merci Bernice)

Meet the health team.

Former Senate Majority Leader Tom Daschle at HHS = serious health plan coming? (Here’s an interview about his ideas for health care.)

Hilary Clinton at State also = good news for health care?

Here’s something else about the Baucus health plan. It calls for scaling back the tax exclusion for health benefits and replacing it with a tax credit. This is one of the best ideas in the McCain plan. Interesting!

Obama’s not the only player in Washington. There are Senators and Representatives too. One of them, Max Baucus, the Senator from Montana, will propose a health plan that includes a mandate. Maybe health care has a pulse.

Reversing Bush’s SCHIP veto comes first; broader reform of health is third.

Universal health insurance isn’t dead? That’s what New Republic health policy reporter extraordinaire Jonathan Cohn says in the November 19 issue.

Yes, I’m posting on November 8 about an article that is “published” on November 19. No one said that magazine publishing makes sense. Here’s hoping that Cohn’s argument does!

Triple play from Greg Mankiw. From that page, you get a link to David Cutler and Brad DeLong’s defense of the Obama health plan, a link to a criticism of that defense, and a link to an op-ed from last year that Mankiw wrote about misleading numbers tossed around in the health care debate.

Alas, one of those misleading numbers concerns costs. Mankiw agrees with Krugman and Wells that costs are driven by technology and rising incomes. In other words, he doesn’t regard it as a problem. And if it’s not a problem, the rationale for a health care plan that takes aim at costs ….

McCain’s tax and health plans are complex enough that they are rarely understood. In particular, the candidate could say, with some justice, that he is offering a bigger tax cut for the middle class than Obama does. But he hasn’t done so. Then again, part of the reason why McCain doesn’t understand this implication of his policy may be that it has changed.

Meanwhile, McCain’s advisers claim his plan won’t do much. It won’t significantly undermine employer-sponsored health insurance and they will adjust the credit with inflation.

McCain advisers counter these concerns. Changing the tax treatment wouldn't hurt the employer-sponsored system and would allow more of the uninsured to buy their own coverage, they say. Also, his advisers say a McCain administration would keep an eye on the credit to make sure it didn't lag behind the cost of coverage, while also working to lower the rate of medical inflation. Younger, healthier workers likely wouldn't abandon their company-sponsored plans, said Douglas Holtz-Eakin, McCain's senior economic policy adviser. "Why would they leave?" said Holtz-Eakin. "What they are getting from their employer is way better than what they could get with the credit."

But if it doesn’t encourage more people to move to the individual market and if the credit moves up with health care costs, then it won’t do anything to limit the rate of inflation in health care costs. I thought that was the whole point. Surely there’s some nuance missing in this snippet. Which didn’t stop me from presenting it to you, of course.

A post at the Tax Policy Center’s blog criticizes the McCain health plan on three grounds. First, it claims the GAP part is inadequately funded; GAP is government insurance for people who have health conditions that render them unattractive to private insurance companies. Second, it speculates that the private insurance policies sold to the poor will be nearly worthless. Third, it suggests that McCain isn’t serious about his plan anyway. Ouch!

Plus we get a link to a report published by the Urban Policy Institute that contends the McCain plan won’t actually address the problem of costs. Double ouch.

All of this would make me feel much better if it were accompanied by equally vigorous and searching support for the Obama plan.

Robert Carroll, a former Treasury Department official, published an excellent analysis of McCain’s health plan. He claims that most people would get more from the tax credit in McCain’s plan than they get from the current tax exclusion for employer-sponsored health insurance.

Carroll also includes this succinct explanation of how the McCain plan proposes to address inflation in the cost of health care.

Consider the current exclusion. Its value rises with how much someone spends on health care, and how much of this spending is funneled through employer-sponsored health-care coverage. This creates an incentive for people to purchase policies with low deductibles, or which cover routine spending. These policies look a lot less like insurance and more like prefunded spending accounts purchased through employers and managed by insurance companies. Consider homeowners and auto insurance policies. Do these cover routine spending on cleaning the gutters or tuning up a car?

The subsidy encourages people to buy bigger policies that cover more, and leads to greater health-care spending. Moreover, lower deductibles and coverage of routine spending dulls consumers' sensitivity to price. Reducing the tax bias should result in insurance that is more focused on catastrophic coverage and less on routine spending.

By replacing the income tax exclusion with a fixed, refundable credit, the McCain proposal reduces the tax bias for large insurance policies. Because the credit is for a fixed amount, regardless of how much you spend on health care, it helps break the link between the existing tax subsidy and how much is spent on health care. This improves incentives in the health-care market by reducing the bias that has contributed to such a high level of health-care spending.Robert Carroll, “Almost Everyone Would Do Better Under the McCain Health Plan,” Wall Street Journal, October 27, 2008.

The graph Carroll provided is also helpful.  It explains how the plan would help those who cannot afford health insurance now.

It explains how the plan would help those who cannot afford health insurance now.

The credit gives much more to people at the lower end of the income distribution than they currently get. That’s what the gap between the blue line and the left end of the red line shows. That should help people who cannot currently afford health insurance.

But what about costs? If you make a lot and currently have health insurance, the credit still gives you more than the tax exclusion does. The blue line is still higher than the red line on the right side. So why would you buy less health insurance with it? Remember, the plan only controls cost if people buy less insurance coverage than they do now. There’s something about this that I don’t understand. Maybe they propose to force people to economize once health care insurance gets more expensive than it currently is. Maybe there’s something else that I’m just missing.

One thing I understand increasingly well is why Oberlander worried about the declining value of the credit. If costs continue to rise, the credit will buy less and less insurance, leaving those in group 3b still without adequate coverage. Could they just keep increasing the credit? If they did that, they wouldn’t limit costs. The whole idea is to force people to economize on health insurance and that wouldn’t work if the government kept bumping up the subsidy.

But this is coming pretty late in the game and you might think it’s not likely that we’re going to see a McCain health plan (though you might hope that some parts of his health plan would be incorporated into whatever is finally passed). What will Obama’s priorities be? The early guessing is depressing: no Obama health plan either.

Already Obama is hinting strongly at what his priorities will be. Consistent with what Emanuel told me, Obama now informs Time’s Joe Klein that endeavoring to spark “a new energy economy [is] going to be my No. 1 priority when I get into office.” At the same time, Obama will surely press immediately for his middle-class tax cut, which happens to be sound economics in recessionary times and also irresistible politically.

What isn’t likely to happen anytime soon is Obama’s version of near-universal health care. Even before the financial crisis hit, a number of senior Democratic lawmakers were quietly expressing doubts about trying to fast-track the issue. “I’m not sure we have a consensus for health care, even on our side,” one Democratic senator tells me. “Remember back in 1992, when Pat Moynihan told Clinton to do welfare before health care and Clinton didn’t listen? That’s a lesson Obama should pay heed to—health care is a quagmire.”John Heilemann, “The Next New Deal,” New York Magazine, October 26, 2008.

A little perspective might be in order. Earlier in the year, Heilemann did an excellent job of reporting Hillary Clinton’s (private) opinion that Obama was doomed to lose. I was almost shaken. Yet here we are planning the Obama administration’s priorities a couple weeks before the election. Still, his sources are legislators who can make these predictions come true; that wasn’t the case with the election.

I finally managed to read parts 2 and 3 of the LA Times series on health insurance. Both are quite good.

Part 2 is about how healthcare companies are making most of their money in financial services. Two changes to the tax code are behind this.

One was the change to ERISA in the 1970s that allows large companies to self-insure and avoid state regulations. The healthcare companies help the self-insuring companies do this. (Brittnee asked why they did this; I still don’t know.)

The other relevant change to the tax code is the one that created Health Savings Accounts. These are tax protected accounts that typically go along with high deductible, low coverage health plans. Basically, you insure yourself with the money in your tax protected Health Savings Account for everything up to really big expenses. Why would the government encourage that? It’s the theory that the way to control inflation in health care costs is by making individuals responsible for their use of the health system. We know the down side: it thins out risk pools.

The article brings out one point that I hadn’t considered about these things. I had assumed they would be attractive mainly to the healthy. But they’re also used by people with chronic conditions. These people can’t get health insurance any other way. The insurance they can qualify for only covers really big expenses due to an accident or something; it won’t cover the ongoing cost of dealing with, say, diabetes or kidney disease. Anyway, according to our reading, Health Savings Accounts aren’t used very much yet. But the article illustrates some of the pitfalls if they become more prominent.

Part 3 gives a partial answer to a question that Ashley asked. Ashley asked if there was any effort to squeeze payments to doctors. Our reading said that had been tried and failed, leading businesses to try individualized plans like Health Savings Accounts. But Part 3 maintains that insurance companies are trying to limit payments to doctors. How? They just don’t pay their bills. I know that sounds weird, but read the article.

The balance of the article is about a more familiar theme: how much overhead the US system of private insurance has. You know the drill, but it’s still shocking to see the numbers and hear the anecdotes.

Health care turns everything upside down. Earlier on this page, we saw Senator McCain criticizing Senator Obama for proposing tax credits that would go to people who don’t pay income taxes. That’s funny because such tax credits are exactly what McCain’s health care plan proposes.

In our reading, we saw Jason Furman, Obama’s chief economics advisor, write favorably about a plan like McCain’s. I have to confess that I missed that when I chose the article. I read the critical remarks about, for instance, tax rebates, and neglected the fact that McCain proposes tax credits. In other words, I assumed that Obama’s advisor would be writing in favor of Obama’s plan and didn’t read the article carefully enough. So we read two articles in favor of McCain’s plan and none in favor of Obama’s.

Anyway, today’s Wall Street Journal quotes David Cutler, Obama’s health economics guru, saying this.

Health insurance is not something that is made better by tying it to employment. As a result, essentially all economists believe that universal coverage should be done outside of employment.

Of course, as we know, Obama’s plan aims to reinforce the employer provided system. It’s a matter of politics and history: that’s the system we have and the Obama team thinks it’s too much to try to rip the whole thing up.

That probably makes sense if you’re thinking as a politician who hopes to pass legislation. But it’s striking that the academic books and articles written by Obama’s advisors criticize the central aim of his plan.

I was taking Milo out for a walk yesterday (Emilio can verify this) when I realized something about the McCain plan (Emilio is probably grateful that I didn’t tell him this part). It has to do with the $5,000 tax credit. I thought that Tanner explained that this was not primarily for buying health insurance. It’s to offset the tax increase when the plan taxes health benefits as normal wages or when employers simply distribute the monetary value of the health benefit as wages. If your employer does the latter, you would buy your health insurance with your increased wages, not with the $5,000.

Since that is what I believed, I had trouble understanding why experts like Jonathan Oberlander thought it was worth pointing out that the value of the $5,000 credit would decrease as cost of health insurance rises along with the cost of health care. “It’s not for buying health insurance,” I thought, “it’s for paying taxes, so the point is marginal at best.” Yesterday, I figured out why I was wrong to think that.

Let’s distinguish three groups of people after the McCain plan has been put into effect.

The way I was thinking of the credit applied to groups 1 and 2. Group 3, on the other hand, will use the credit to buy health insurance. Within group 3, we can distinguish between:

Sub-group 3b. will be particularly interested in the credit. For them, it might make the difference between being able to afford health insurance and not being able to afford health insurance. So for them in particular, the fact that the credit will buy less and less health insurance over time is potentially a big deal. So now I see what Oberlander and others were getting at. They were thinking of group 3 and I was ignoring it. Doh.

McCain’s supporters might answer that it’s not as though the members of group 3 would be worse off than they are now. They’ll have $5000 to add to their current health budget! They might also say that the plan will control costs, such that the value of the credit won’t decline over time. Finally, of course, they could propose increasing the credit if its value declined too much. My point isn’t that this is a decisive objection. It’s that I finally understand why it’s an objection in the first place.

The LA Times has a three-part series on health insurance. Today’s installment is on the perils of the individual health insurance market. It’s full of illustrative annecdotes, numbers that we’re familiar with by now, and the colorful graphics they’re using to cover up the shrinking text. Anyway, it’s a fine story. It’s nothing you don’t know, but it’s well done.

The financial mess isn’t strictly on topic but it is obviously important for pretty much everything. And it’s something that a lot of us are worried about. I thought that this article by Dani Rodrik does a good job of (a) identifying the possible causes and (b) explaining why we don’t really know how to apportion the blame.

China is planning (nearly) universal health insurance. And thank goodness (benefits to the eminently worthy people of China aside):

Overhauling China's health-care system has global significance, given the country's demographic heft, its frequent role as epicenter of infectious diseases and its growing importance in health innovations ranging from organ donation to the use of traditional Chinese medicine.

McCain accuses Obama of turning the tax code into a welfare program. Why? Because Obama would offer tax credits even to people who don’t pay income taxes (see the last two paragraphs). Of course, that’s what McCain’s health plan does too (correctly noted in the third paragraph).

Campaigns are funny things.

Greg Mankiw notes that Obama’s health plan strongly favors employer-provided health insurance over individually purchased health insurance. Why? Because employees who work for large companies that don’t provide insurance and who buy insurance for themselves would bear a double burden. A large employer that doesn’t ‘play’ by providing insurance for its employees has to ‘pay’ into a government fund. The employees who buy their own insurance pay for their health insurance and lose the wages that their employers ‘pay’ into the government fund.

I have the feeling that the Obama team doesn’t expect that it would work this way. That is, I thought they planned to use the government fund to help precisely these workers, thereby avoiding the double burden. But I have to confess that I don’t know exactly how that is supposed to work. So perhaps I’m wrong. Maybe the ‘double burden’ makes it overwhelmingly likely that they would provide health insurance for their employees to avoid losing them to employers who only give them the single burden of paying for a health insurance plan.

The Director of the Congressional Budget Office comments on the relationship between the financial crisis and health care reform.

Greg Mankiw prefers the McCain plan to Obama’s. He notes that Jason Furman wrote favorably about part of the McCain approach in the article we read. Furman is one of Obama’s advisors on economics.

What, you didn’t go to the California Endowment to hear about the politics of health care? That’s OK, you can watch it any time.

Both groups (in ID-1) mentioned the cost of the financial bail-out as potentially limiting either candidate’s health care plans. And maybe that’s right, politically speaking. But it’s a separate question whether it’s the way it should be. Bear in mind that economists usually recommend increasing spending and/or tax cuts when the economy turns down. Basically, the government borrows against the future in order to keep economic activity high. If it works, the economy grows rather than shrinks and the society has wealth left over even after paying off the debt.

As we know, exactly what the Rand experiment proved about individual health care decisions is in dispute. Furman cited two sources to back up his interpretation that are easily available.

Here’s another California Endowment program on health care and the election. This one is in concert with the Patt Morrison show, a talk show on KPCC.

Join Patt Morrison on Tuesday evening, October 14, at 7 p.m. for a debate between health care advisors for the McCain and Obama campaigns.

The event is at The California Endowment, 1000 North Alameda Street, and is open to the public. To attend, please RSVP to pattmorrison@kpcc.org.

YOUR TURN: Do you have a question you'd like to put to the health care advisors for the campaigns? Call us and leave the question on our answering machine. The number is 626-585-3216. Please leave your name, what city you live in and your question for the advisors. We may use your question during the debate.

And who would have better questions than us?

Henry Aaron has a very interesting article (post?) comparing the health care plans. Aaron is a big wheel in the health economics biz: for example, he’s one of the co-authors of one of the books that the Krugman and Wells article nominally reviewed. His take-away? “Achieving universal coverage is mostly about income redistribution—among politically and economically powerful payers and providers with stakes that dwarf those measured by the added system-wide cost of insuring everyone.” In other words, it’s politics, not economics, that’s the barrier to universal coverage.

There are other pieces by Aaron that look interesting too.

Good headline for a good column: “The Real Risk of McCain's Health Plan it's not the taxes -- it's the erosion of risk-sharing between the healthy and the sick,” by Ron Brownstein in the National Journal. (Brownstein is a political reporter; his wife works for McCain’s campaign.)

The Obama plan would make employment more expensive. It puts a payroll tax on each employee: the employer must either play (by providing a health benefit) or pay (by paying into a government health care fund). That’s a disadvantage: we don’t want to make labor more expensive than it has to be.

But the McCain plan also makes work more expensive. It taxes a kind of compensation that is currently not taxed: health benefits. In other words, the McCain plan puts a tax on employment too. It’s an income tax rather than a payroll tax. Of course, the $2500 individual or $5000 family tax credit is supposed to offset the increased income taxes. So maybe this is a wash.

In any event, I don’t know how to compare the effects of the two plans. I’m just pointing out that negative effects on employment aren’t only a problem for the Obama plan.

The Wall Street Journal editorial page is against the Obama plan. No surprise there. One of their arguments is surprising. It’s that Obama’s plan keeps a regressive tax break rather than the McCain plan’s more progressive tax credit. The Wall Street Journal favors progressive taxation! Funny things happen in politics.

The New York Times is publishing a running discussion between two health care experts: Health Watch.

Frontline did a good documentary comparing health care systems in different countries.

McCain’s health plan appears to be hard to sell. Pity. I think it has some interesting ideas. But it’s a Democratic year.

Two pro-Obama takes on health care reform, reflecting his decision to start talking about it.

First, Paul Krugman, Princeton economist and Times editorialist, hits the weak spot of the McCain plan: adverse selection. Adverse selection means that insurance companies want not to insure people likely to get sick, just as casinos want not to provide slot machines that win more often than they lose. One advantage of the employer-based system we have now is that insurance companies have to take everyone who works for a particular company if they want to sell insurance to anyone at that company. So employer-based insurance is a way of getting a somewhat broad risk pool. Individual insurance markets don’t do that but that is the kind of insurance market that the McCain plan favors.

Second, Jonathan Cohn, a journalist who has made health care his beat, comments on how the campaign has turned to health care. While he supports Obama, he is fair to McCain too.

Cohn has a follow-up that draws on a story in the Wall Street Journal. These articles make the same point that the Tax Foundation did a few days ago. Cohn adds a chronology of changes in the McCain plan. That’s helpful to me, since most of this caught me by surprise. Now I know why: it wasn’t in the plan as of this summer. Or, to be fair, it wasn’t in the plan as I understood it this summer.

These articles also add a surprising new twist. Team McCain is talking about finding savings in Medicaid and Medicare to make up the shortfall that their tax credit will cause. Hey, maybe the Reagan thing was intentional!

Hey, they’re talking about health care! Here’s Obama’s press secretary:

“In the next phase on the campaign trail, on TV, in the mail and on the radio, we are going to do two things: 1) Educate voters about voters about Senator Obama’s plan to get all Americans affordable, acceptable health care; and 2) Make sure that voters know what John McCain isn’t telling you about his health care plan.”

Don’t put your reports on hold waiting for elaboration of part 1. Expect quite a lot of part 2. Campaigns don’t typically get more substantive towards the end.

The New England Journal of Medicine has published statements from each candidate about health care.

As a bonus, each statement is accompanied by a critical essay: “Primum Non Nocere — The McCain Plan for Health Insecurity” and “Symptomatic Relief, but No Cure — The Obama Health Care Reform”. Guess who takes which side! Senator, we invite you to address our readers … from the boxing ring!

If your tastes run to a big old page of links, Real Clear Politics has one devoted to the politics of health care.

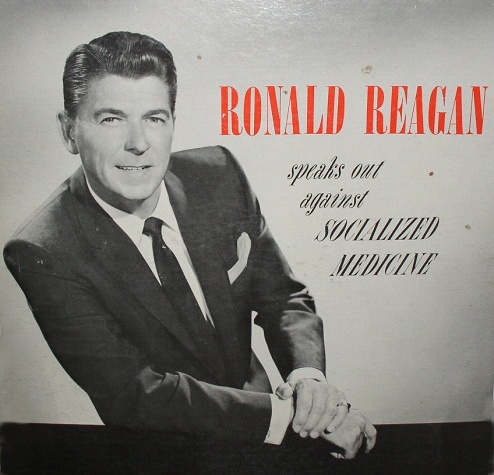

I didn’t know that Governor Palin was quoting one of Ronald Reagan’s speeches against Medicare in last night’s debate. Thanks to the wonders of the internet, you can listen to it yourself.

I didn’t know that Governor Palin was quoting one of Ronald Reagan’s speeches against Medicare in last night’s debate. Thanks to the wonders of the internet, you can listen to it yourself.

Ah history. One generation’s threat to liberty is another’s untouchable entitlement. Of course, that was one of Reagan’s points.

On the subject of the debate, apparently “neither side appears to understand” McCain’s health plan. Ouch! Well, we know that the Democrats are going to emphasize the bit where it makes health benefits taxable and the Republicans are going to emphasize the bit where it gives a tax credit. The Republicans get the cost wrong. To pay for the credit, McCain proposes to remove the individual tax exemption for health benefits, but that alone won’t cover the credit’s cost. To do that, he “would essentially have to eliminate the exclusion from payroll taxes for employer-provided health insurance as well as the income tax exclusion,” which he does not propose to do. As it stands, McCain’s plan would cost the government as much as Obama’s, according to the Tax Foundation. (You have to scroll all the way to the bottom for the health care goodies; the rest is a sphaghetti bowl of tax code detail that makes my head hurt.)

Finally, I know that I emailed everyone about this, but it’s worth repeating. The California Endwoment will have a public program on Health Politics with Mark Halperin, Chris Lehane and Adam Mendelsohn. It’s on Thursday, October 9 at 5:30 pm. You get there by taking the MetroLink train from Claremont Station to Union Station and walking a couple blocks to the California Endowment’s building. They ask that you RSVP first (follow the first link in this paragraph to do so). Easy!

Fresh off the wire: “Obama's health plan may help more uninsured: report”. It’s a news service bit on a newly released analysis of the competing healh plans by the Commonwealth Fund. The website for said report is pretty snazzy. Plus, you can read the actual report [pdf]! That way, you can distinguish yourself from your fellow citizens, who mostly scan news stories to confirm that their side is right or that journalists are stupid or biased.

Incidentally, would it have killed some of these big brain think tank types to have published their comparative pieces before, oh, the first of September? Someone was making a syllabus back then and really could have used a few of these. Oh well, it’s better material for your research projects than for the syllabus anyway.

In other news, Paul Menzel’s piece comparing the health plans, “Too Hot for Politics to Handle? Hard Questions about Health Insurance”, has now been published in the September/October issue of the Hastings Center Report. You can view it for free after creating a free account with the Hastings Center. Or you can view it for free by using one of the databases that the library has paid for, such as Project Muse. (If you’re a member of ID-1, this is already one of our readings; the only thing special here is the professional typesetting).

Earlier, I referred to a lecture Marcia Angell delivered at Princeton: “Reforming Our Health System: Why Neither Candidate Has the Answer.” It is now available.

A premise of the first question asked in the foreign policy debate is that the bailout of the financial system will impose serious constraints on the budget. That’s why the moderator asked each candidate what he would give up. Neither answered, of course. The most obvious casualty for either candidate would be plans to reform the health care system as both would offer new subsidies for health insurance.

But is the premise true? Larry Summers, the highly respected former Secretary of the Treasury in the Clinton administration, says it isn’t.

The American experience with financial support programmes is somewhat encouraging. The Chrysler bail-out, President Bill Clinton’s emergency loans to Mexico, and the Depression-era support programmes for housing and financial sectors all ultimately made profits for taxpayers. While the savings and loan bail-out through the Resolution Trust Corporation was costly, this reflected enormous losses in excess of the capacity of federal deposit insurance programmes. The head of the FDIC has offered assurances that nothing similar will be necessary this time. It is impossible to predict the ultimate cost to the Treasury of the bail-out programme and of the other guarantee commitments that financial authorities have – this will depend primarily on the economy as well as the quality of execution and oversight. But it is very unlikely to approach $700bn and will be spread over a number of years.

For example, according to an article in the LA Times, the government’s stake in AIG is already worth more than it cost.

So maybe health care reform is still possible.

There should be an award for Awkward Copy Submitted in Advance. This is by someone writing on behalf of John McCain. It was published in the September/October issue of Contingencies [warning: really big pdf file], a trade magazine for actuaries. It was brought to the world’s attention by economist/op-ed writer Paul Krugman.

Opening up the health insurance market to more vigorous nationwide competition, as we have done over the last decade in banking, would provide more choices of innovative products less burdened by the worst excesses of state-based regulation.

Strictly speaking, this isn’t as damning as it looks. McCain wants a national health insurance market rather than the present one, where you can only buy health insurance approved by your state government (I think). Why? Some states require minumum coverage, meaning you can’t buy less, and less costly, insurance if you want to. I don’t know whether deregulation to encourage national banks is to blame for the current mess or not, but it isn’t the most obvious candidate.

On the other hand, since the whole thrust of this part of McCain’s plan is to reduce regulation of insurance markets on both the national and state levels, perhaps the blue team can make a valid point somewhere around here.

In any event, the analogy rings false when pseudo-McCain predicts that national competition in health care insurance will “wring out excess costs, overhead, and bloated executive compensation.” Has deregulation of financial services cut deeply into “bloated executive compensation”? I would hate to see true bloat if their current compensation packages are lean and mean.

Anyway, in the wonkier regions of the internet, Obama-supporting economist Brad DeLong prints a response to criticisms of McCain’s health plan.

The Henry J. Kaiser Family Foundation has a chart comparing the health plans.

Good news, bad news. First, the bad. Marcia Angell, the former editor of the New England Journal of Medicine, gave a public lecture at Princeton claiming that neither candidate’s plan will solve the problem with the health care system. Here’s about half of the abstract.

Both major presidential candidates promise to reform our health system incrementally. But they face the following dilemma: If they try to control costs, coverage will inevitably shrink. On the other hand, if they try to expand coverage, costs will rise. The candidates have embraced opposite horns of this dilemma. Senator McCain has opted for holding down costs by passing more of the burden to individuals, even though it means more people will be without health care. Senator Obama has opted for increasing coverage, even though it means adding to the staggering costs. Neither is a long-term solution. The only way to have universal health care at a sustainable cost is to overhaul the system entirely. Dr. Angell will explain why that is so, and what needs to be done.

And the good news? You can see the lecture yourself. Without having to live in, or even travel to, Princeton. Er, you can see it eventually. They haven’t posted it yet. I guess that’s one advantage to living in Princeton.

Two economists and a lawyer make the case for Obama’s health plan in the Wall Street Journal or, if you prefer bullet points, on a blog.

There’s an article in the Wall Street Journal reporting on a Tax Policy Center comparison of the plans. The reporter wrote a blog entry adding some detail and links.

Health Affairs has published twin critiques: one directed at Obama, the other at McCain. Naturally, a third article looks at combining them. Their health plans, that is.

The New England Journal of Medicine has a special page devoted to the election. In particular, Jonathan Oberlander’s article “The Partisan Divide — The McCain and Obama Plans for U.S. Health Care Reform” looks very helpful.

I just listened to an interview with Oblerlander by Terry Gross that I recommend highly.