We talked about three major sections of Gruber’s article:

The number of people who lack insurance is increasing as health costs are increasing. On the face of it, that’s odd. The demand for insurance should go up when the cost to be insured against rises. That’s why you buy insurance for expensive stuff, like having your house burn down: it’s more expensive than you could afford to pay for yourself.

The health insurance plans that we have are very generous at covering routine, predictable care. There is no significant market for health insurance that covers only very expensive things and leaves the routine or less expensive items out. This is odd because your premiums will have to cover the routine, predictable care. So you’re not saving anything by using insurance to pay for it. But the RAND study suggests that using insurance means you’ll consume more health care than you would if you were paying directly, in cash. In other words, it seems that our preferred way of paying for routine care leads to our buying more routine care than we, in fact, want to pay for. And this makes no sense.

These things may well be related. People get priced out of the market for health insurance, even if their desire to buy health insurance goes up with the cost of health care. This might be so because there are no inexpensive health plans that cover only very expensive care.

Jon was certainly right that there is probably some psychological misunderstanding going on here. We think that we’re getting something for nothing when, in fact, we’re paying for it. And Jennifer had an intriguing point about how health providers charge individuals more than insurance companies. Perhaps that explains why we prefer to make all of our payments through insurance companies: we get a better deal. And the providers get the benefit of our using their services more than we otherwise would!

Professor Brown reached through the ether to remind me of the all important distinction between health care and health insurance by sending me a link to this op-ed in the Times.

And in addition to the research Gruber cited, there is a new study about the health effects of lacking insurance:

Research released today in the journal Health Affairs, by me [Austin Frakt] with colleagues Steve Pizer and Lisa Iezzoni, shines light on a particularly vulnerable set of Americans in desperate need of health insurance and the access to care it would facilitate. In particular the study reveals that low-income people with chronic health conditions or disabilities can have outrageously high uninsurance rates, nearly 50% if they live in the south and do not qualify for public health programs.

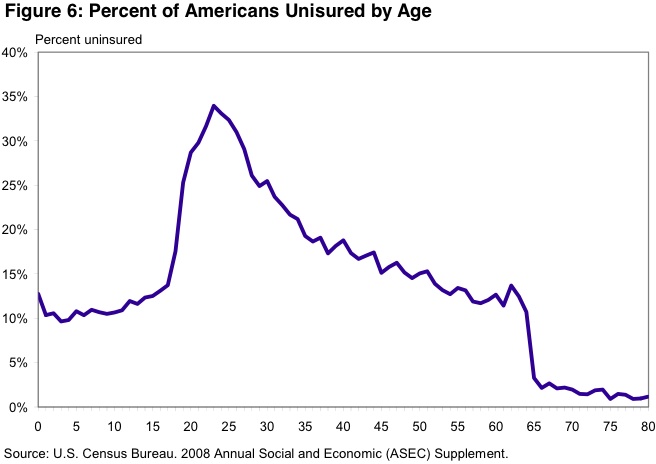

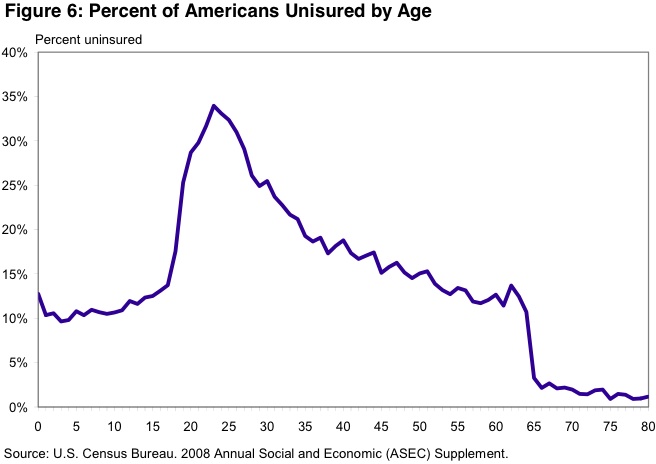

That is, what percentage of people in each age group lack insurance? Here’s a neato chart from the Coucil of Economic Advisors report on health care.** The Economic Case for Health Care Reform, June 2009, p.7. Added October 25.